The agency states that meme coins are more akin to collectibles than currency or investments.

Expanded Understanding of Meme Coins

Meme Coins Defined

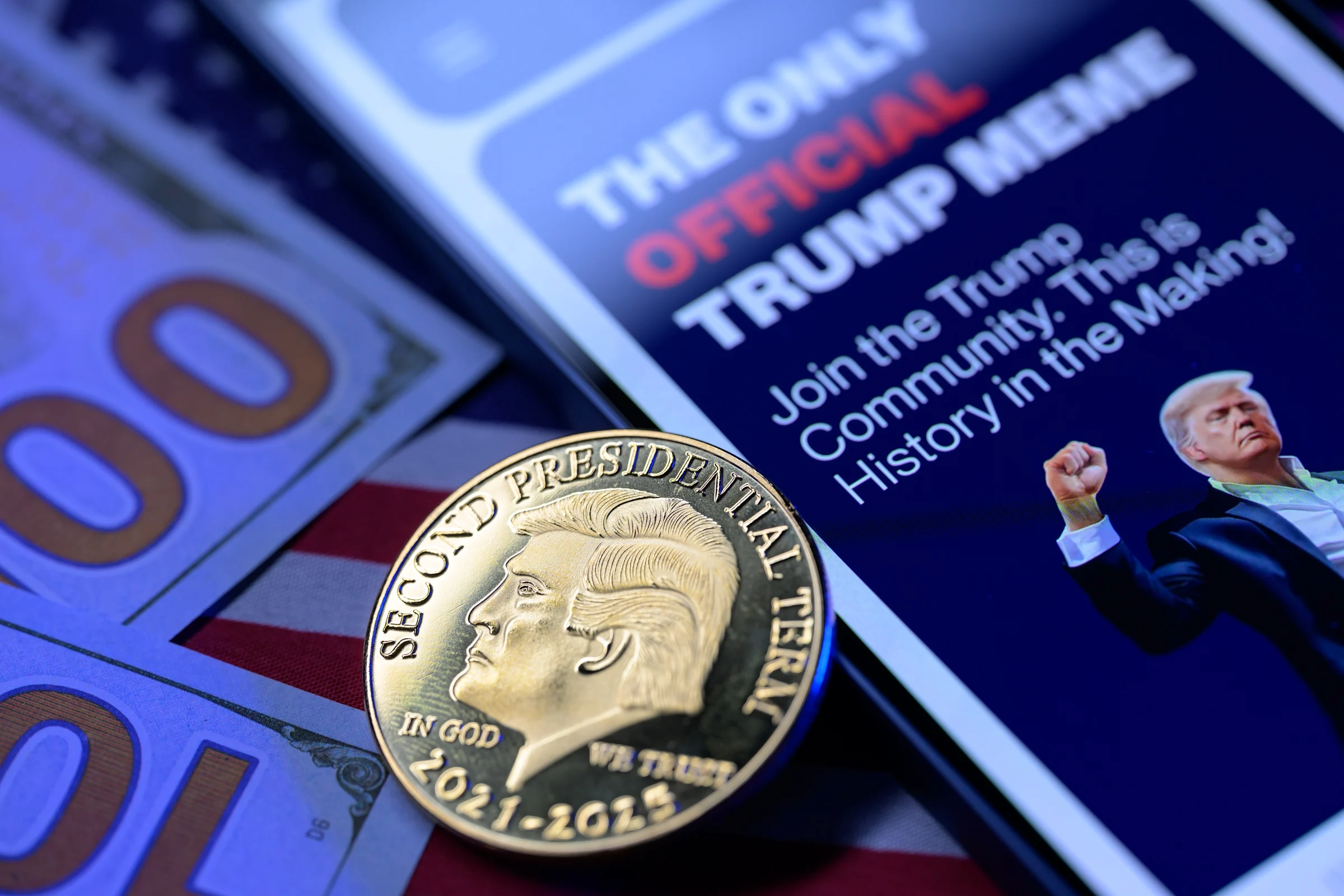

Meme coins are cryptocurrencies that emerge primarily due to social media trends, memes, internet culture, or viral movements. These coins are often created without any underlying technological innovation or practical application beyond their entertainment value. The most well-known meme coin is Dogecoin, which was initially launched as a joke based on the popular Doge meme. Despite this, Dogecoin and other meme coins have gained significant traction, sometimes seeing massive price surges driven by social media influencers, celebrity endorsements, and viral trends.

Meme coins can generate significant market activity, they are not based on any fundamental business model or revenue-generating asset. This lack of intrinsic value and business purpose is one reason why the SEC does not classify them as securities.

Why Meme Coins Aren’t Securities: A Deeper Look

The SEC’s legal framework for defining securities is rooted in the Howey Test, which originates from a U.S. Supreme Court decision in 1946. According to this test, a financial instrument is classified as a security if it meets four conditions:

- An investment of money: The individual expects to put their funds into something with the expectation of profit.

- In a common enterprise: The investment is part of a collective effort, typically a business or organization that generates profits.

- With an expectation of profits: The individual expects their investment to generate a return (such as income, profits, or appreciation).

- From the efforts of others: Profits are primarily dependent on the efforts or managerial expertise of others (such as business management or a corporate team).

Lack of Profit-Generating Characteristics

Meme coins fail to meet several of these criteria, specifically:

- No business behind the coin: Meme coins do not represent a business entity that aims to generate profits through services or products. There’s no operational structure or business model behind them.

- No yield or income generation: Meme coins do not produce income, dividends, or other forms of profits that investors can receive. Their value primarily fluctuates based on speculative trading and market sentiment.

No reliance on a management team

The value of meme coins does not depend on a centralized group or company managing the coin’s future. Their market price is influenced by market participants, rather than a centralized authority working to make the coin more valuable over time.

Because of these factors, meme coins do not fulfill the definition of securities and, therefore, are not regulated under the U.S. Securities Act, which governs stocks, bonds, and other securities.

SEC’s Approach Toward Meme Coin Trading

Trading Activity and Market Speculation

Since meme coins do not constitute investments in a business, buyers are essentially engaging in speculative trading. This trading activity, while not regulated by the SEC, can create highly volatile market conditions. Market participants may invest in meme coins hoping to sell them at a higher price, driven by trends, social media buzz, or other speculative factors. However, this speculative nature does not mean the SEC considers meme coins as securities.

The SEC has acknowledged that this type of trading is largely driven by speculation and market psychology rather than an inherent value of the coin itself. As such, the SEC compares meme coins to collectibles, similar to rare baseball cards or digital art NFTs, where the value is derived from demand and rarity rather than underlying assets or income potential.

No Federal Protection for Buyers

One important implication of the SEC’s stance is that people who buy meme coins are not protected by federal securities laws. For example, they don’t benefit from the same disclosure requirements that apply to stock investments. When someone buys stocks in a company, they expect to see regular financial disclosures, audited financial statements, and other transparency that help assess the company’s financial health. This is not the case with meme coins.

This lack of regulatory oversight could expose buyers to potential fraud or market manipulation, as they are not receiving any of the same safeguards or regulatory protections that investors in traditional securities receive.

Ongoing Scrutiny for Fraudulent Activities

Despite the absence of securities regulations, the SEC has made it clear that fraudulent activities related to meme coins could still be investigated and prosecuted under other federal and state laws. This could include:

- Fraudulent Promotion: If someone misleads or deceives investors into buying meme coins with false claims about their value or future potential, that may be subject to enforcement under consumer protection or fraud laws.

- Market Manipulation: Engaging in practices like pump-and-dump schemes, where the price of a coin is artificially inflated and then sold off for profit, could also be investigated by the SEC and other authorities.

Meme coins are outside the SEC’s regulatory umbrella, fraudulent or deceptive behavior could result in legal consequences, as it still violates other laws designed to protect the public.

Meme Coins as Cultural Phenomena

Meme coins reflect the growing intersection between finance, entertainment, and social media. This phenomenon highlights how digital communities can drive financial markets, with value often created not by tangible assets or business plans, but by collective interest, memes, and digital culture.

- Influencer Impact: Celebrities, tech influencers, and even prominent figures in the cryptocurrency space (e.g., Elon Musk) can significantly impact the market for meme coins through social media posts, tweets, or public endorsements. This can lead to extreme price volatility, where meme coins rise and fall based on the whims of influencers or viral moments, rather than business fundamentals.

- Community Engagement: Meme coins often attract communities that are united by shared humor, memes, or internet culture. These communities can drive demand for the coins, increasing their market value, even though the coins themselves lack any inherent business purpose or product offering.

SEC’s Future Actions and Meme Coin Regulation

Meme coins are not classified as securities, the SEC has reserved the right to step in and evaluate transactions involving meme coins if suspicious activity arises. For instance, if a meme coin were to transition from being a joke or speculative asset to a more serious investment vehicle—perhaps by introducing new utility or functionality—the SEC could reevaluate its status and consider it a security subject to regulation.

The SEC’s ongoing surveillance of the cryptocurrency market means that even assets not classified as securities will be subject to scrutiny for potential fraudulent activities. This could be especially relevant if scammers or malicious actors attempt to exploit the lack of oversight to deceive investors or manipulate prices.

Frequently Asked Questions

What are meme coins?

Meme coins are cryptocurrencies created as jokes or memes, such as Dogecoin or Shiba Inu, and often have no specific utility.

What does the SEC say about meme coins?

The SEC states that meme coins are not considered securities and are not regulated under federal securities laws.

Why is the SEC not regulating meme coins?

The SEC does not consider meme coins as investment contracts or assets that meet the definition of securities.

Does this mean meme coins are illegal?

No, it simply means they are not regulated under securities laws, but they may still be subject to other regulations like anti-money laundering.

What is a security under federal law?

A security is generally an investment contract, such as stocks, bonds, or certain cryptocurrencies, subject to SEC oversight.

Could meme coins be regulated in the future?

Yes, the SEC could change its stance depending on market developments, but for now, they don’t meet the definition of securities.

Are there risks in investing in meme coins?

Yes, despite the lack of regulation, meme coins can be volatile and speculative, and investors should be cautious.

How does this impact the crypto market?

It means meme coins won’t face the same scrutiny or requirements as securities, possibly leading to less protection for investors.

What are the implications for exchanges offering meme coins?

Exchanges that list meme coins may not be required to follow strict securities regulations, but other laws may apply.

What role does the SEC play in regulating cryptocurrency?

The SEC primarily oversees cryptocurrencies that are classified as securities, ensuring investor protection and market integrity.

Conclusion

The SEC’s stance on meme coins clarifies that these digital assets are not classified as securities under federal law. This means meme coins are not subject to the same regulatory requirements as other investment vehicles like stocks. However, while they aren’t regulated by the SEC, other regulatory frameworks could still apply, such as anti-money laundering laws. Investors should exercise caution due to their speculative nature and volatility, as the lack of regulation doesn’t eliminate risk.